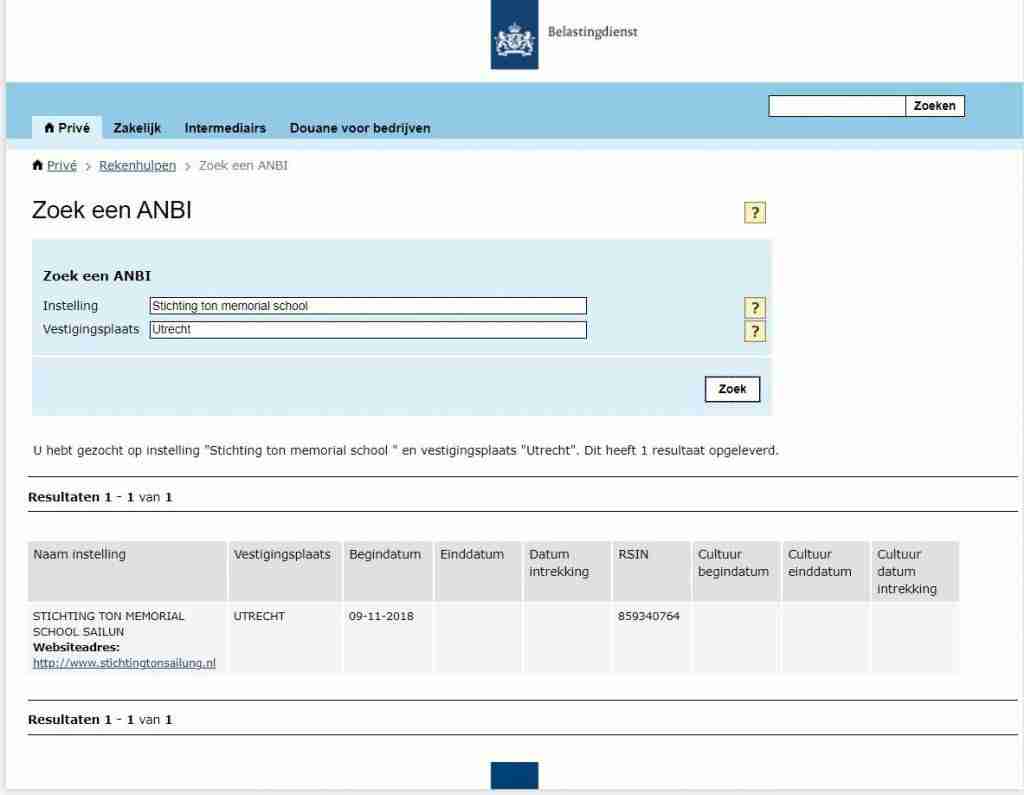

Foundations that meet certain conditions are designated and registered by the government as an ANBI. An ANBI has a number of tax advantages. Ton Memorial School Sailung Foundation is ANBI registered.

RSIN / fiscal (identification) number: 859340764

The advantage of donating to ANBIs is that you can deduct the gift in whole or in part from your taxable income. The Tax and Customs Administration therefore pays for your donation. By making smart use of the tax benefit, you can donate more with the same money because the tax authorities pay back the difference after income tax returns. So you can choose to keep the benefit or to donate extra to the Foundation.

It is therefore attractive for you to support the Ton Memorial School Sailung Foundation once or as a regular donor.

If you are considering a periodic donation, this can be recorded in writing by means of a Donation agreement.

You can download a donation agreement above or request it from the treasurer info@Sailung.nl

Periodically donate ANBI.

A regular donation / gift is a structural donation to a charity (ANBI) that is laid down in writing in a private donation agreement. The term of this agreement is at least five years. You must pay a fixed amount at least once a year. You can decide for yourself whether you split that annual amount into multiple amounts, and for example pay part of the annual amount to an ANBI each month, or whether you pay the annual amount in one go.

The big advantage for you is that your gift is fully deductible from your taxable income and therefore you receive part of your gift back from the Tax Authorities. Gifts that are not recorded in writing as a periodic donation / gift are not fully deductible.

By recording the donation in writing, you can therefore:

The tax benefit depends on your income, the income of your tax partner and the age of both of you. This benefit can go up to 46%. * The percentage will be reduced to 37% in the coming years. You can calculate the income tax benefit yourself with the Gift calculator >>>

The benefits for charities are that with your structural support they will gain confidence and financial resources to achieve their goals. If you donate your tax benefit, the charity can count on a larger amount while you no longer have to pay for it.

Do you want to convert an existing donation or do you want to directly support a charity with a periodic donation? Then you require one gift agreement. required. This agreement is valid without a notarial deed. For the tax break, the agreement must be in place for the first donation. If you arrange the donation through a periodic payment of your bank, then there is no further need to worry.

Have you not paid the donation for at least 5 years in a row, for example because you become unemployed? Or because the ANBI or association no longer exists? In that case, you may still deduct the amounts paid, but only if you have ticked on the gift agreement that you may also discontinue the annual payments in the aforementioned cases.

With your support, we will continue with confidence.

2023: It has already been 5 years since Ton passed away in Nepal and that we as a foundation, with your support, have committed ourselves to making his dream come true. The Ton Memorial School is flourishing, with an increase of 22 students to 124. We are proud to report that the school took first place in the regional school test for classes 3 and 5, and even managed to impress the education inspector.

Our involvement goes beyond education. Construction of the Birth Center is almost complete, thanks to the extraordinary work of the construction team and the community. The agricultural project has also started the initiation phase in a promising manner, with the help of partners such as ISARD and ICFON.

The year 2024 brings new opportunities and challenges, but we look forward to it with confidence.

2022: A year of impressive progress at Sailung! With the successful completion of school and sanitary buildings and the welcome of a new bus, access to education has increased. The Container Project has brought a lot of material to the school and community. Thanks to countless donations and expansion of child sponsorship, valuable steps have been taken. Special recognition for all generous contributions that will also allow the construction of the health center to start in 2023.

Namaste for all the support.

2021 the year of construction and opening of the school on November 1. Phase 2 has also started.

In addition to the many donations, we have welcomed 10 regular donors to sponsor the education of children. Thanks for all the support that made this possible.

2020 thanks to all donations the construction of the Ton Memorial School as of October 1 from start .

The number of regular donors who sponsor a child's education has increased by eight. We have also been able to provide more than 40 families with a cooking stove.

The Foundation was established on November 9, 2018.

Financial matters from the incorporation period to December 31, 2018 are accounted for in the annual report of 2019.